Mobile money and agent banking are driving greater financial inclusion among the underserved

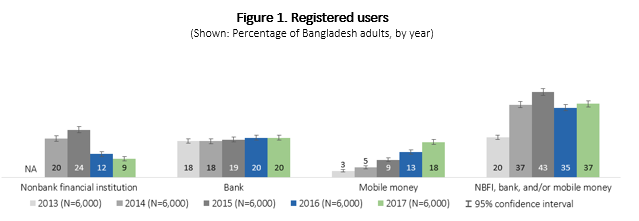

From 2016-2017, an additional 2% of Bangladesh’s adult population (15+ years old) gained access to a registered account with a full-service financial institution, according to InterMedia’s Financial Inclusion Insights (FII) 2017 survey. That’s about 1.9 million more people financially included compared to 2016.

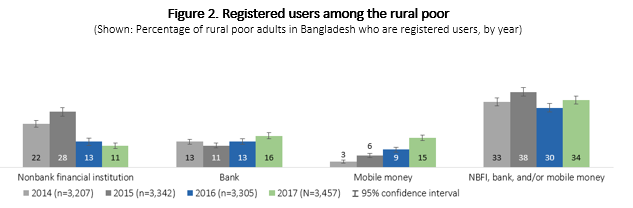

The gains were even greater among the 58% of Bangladesh adults counted as rural poor. Financial inclusion increased by 4 percentage points among rural poor adults – twice as fast as for the population as a whole.

Bangladesh, however, maintains a gender gap of 12 percentage points (43% of men were financially included compared to 31% of women) – much greater than the global average of 9 percentage points reported by the Global Findex.

With increasing levels of mobile phone ownership and SIM card registration, particularly in the rural population, much of the gain in financial inclusion over 2016 to 2017 comes from the adoption of registered mobile money accounts, which grew by 5 percentage points among rural adults. Bank users did not grow significantly, and registered users of microfinance and other nonbank financial institutions (NBFIs) declined slightly over the year (see Figure 1).

These gains are taking place in the context of an enabling environment created by the Government of Bangladesh. For example, the government is promoting digital financial inclusion through its Perspective Plan 2021 (also called Vision 2021). One objective is achieving a “Digital Bangladesh” through information and communication technology (ICT). For instance, the public sector innovation agency, Access to Information (a2i), has formed a partnership with the central bank to focus on improving public service delivery through the use of digital financial services (DFS).

Regulatory action is encouraging registered use of mobile money in the attempt to stamp out over-the-counter transactions from the account of one agent to another. Bangladesh Bank (the central bank) lowered limits on cash-in and cash-out, capped the number of transactions from an individual account, and stepped up enforcement of record keeping for every mobile money transaction. However, by capping the frequency and value of transactions, these rules limit the utility of mobile money for payments.

Financial inclusion among the historically underserved rural poor group received a boost, increasing from 30% in 2016 to 34% in 2017. More adults living in rural areas and below the poverty line registered new mobile money and bank accounts, while registered users of NBFIs declined slightly (see Figure 2). Registered mobile money users grew by 6 percentage points among the rural poor. Also, while there was no change in the prevalence of registered bank users nationally, they increased among the rural poor by 3 percentage points.

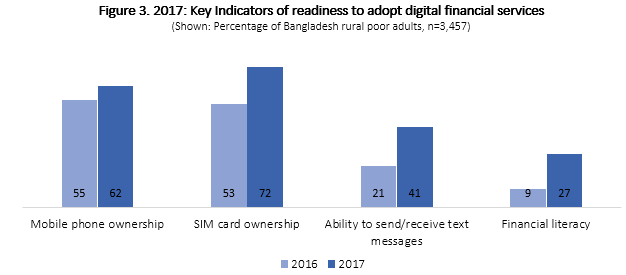

In addition to ownership, the survey found large gains in the number of rural adults who could send text messages and had high levels of financial literacy, potentially indicating more opportunities for deepening digital financial service usage. The increasing infrastructure of agent banking is also changing the landscape of financial services in Bangladesh, and bringing banking services closer for many rural communities. FII data point to a few key factors that likely resulted in the spurt in financial inclusion among the rural poor:

1. Access to key resources necessary to use mobile money increased among the rural poor. Mobile phone ownership and SIM card ownership are the two key resources needed for adults to use mobile money services. In the last year, mobile phone ownership increased 7 percentage-points while SIM card ownership increased 19 percentage-points among rural poor adults, creating better pre-conditions for mobile money adoption.

2. Tremendous improvement took place in readiness indicators and digital skills. The Bangladesh government has been increasingly prioritizing DFS adoption among the rural poor by implementing several interventions through the Access to Information (A2I) division. Additionally, BRAC and other NGOs working in the financial inclusion space have been implementing interventions focused on increasing financial literacy and skills among poor people to encourage them to adopt and actively use DFS. These efforts are showing tangible results. In a span of just one year, financial literacy levels among the rural poor increased three-fold. Additionally, the ability to text, which is a key skill for using mobile money services, increased by 20 percentage points among the rural poor (see Figure 3).

3. Proximity to financial points-of-service among the rural poor has increased. Since 2016, the Bangladesh Bank has been endorsing agent banking to provide financial services to people in rural and remote parts of the country. In 2017, a total of 17 banks have agent-banking licenses, and the latest numbers from the Bangladesh Bank show that the number of agent banking accounts has exceeded 1.4 million. FII data show that between 2016 and 2017 more respondents reported living in closer proximity to bank and mobile money points of service, and the increase was greatest among rural poor adults.

Going forward

Positive developments in Bangladesh have enabled the existing financial services market to reach historically underserved adults that are less likely to be financially included and more vulnerable to income shocks. Women are, however, much less likely to be financially included than men. Closing the gender gap requires concerted effort to accelerate the growth of financial inclusion among women. The FII team will continue to examine the challenges and identify opportunities to drive even more accounts among the rural poor and women in Bangladesh.

For more information regarding the FII team’s research in Bangladesh, read the 2017 Bangladesh Annual Report, or contact Ridhi Sahai, Research Manager, Financial Inclusion Insights. If you are interested in seeing additional information about the factors that affect financial inclusion in Bangladesh, we encourage you to visit the Data Fiinder at finclusion.org.

Financial Inclusion Insights is an ongoing research program funded by the Bill & Melinda Gates Foundation and designed to build meaningful knowledge about how the financial landscape is changing across eight countries in Africa and Asia (Bangladesh, India, Indonesia, Kenya, Nigeria, Pakistan, Tanzania and Uganda).