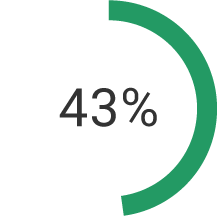

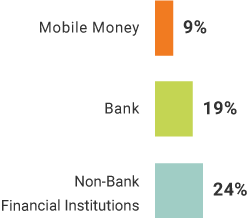

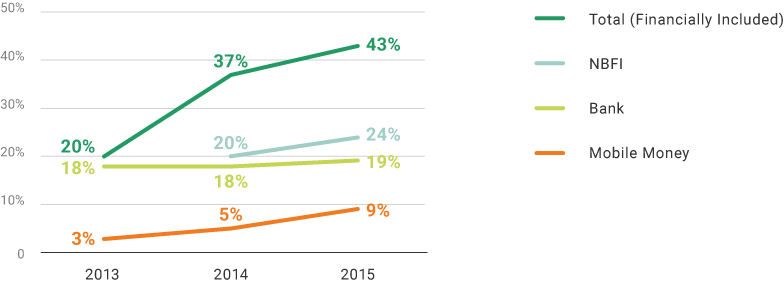

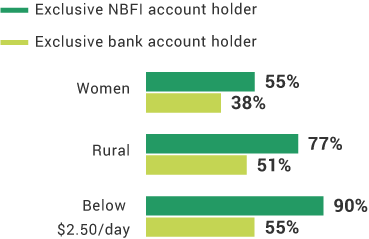

More than seven in 10 adults in Bangladesh live on less than $2.50 a day. For them, saving money is fundamental to building a better and more secure future. The percentage of Bangladeshis with formal financial services accounts more than doubled from 20% to 43% between 2013 and 2015. Ever-growing access to financial services, including mobile money, means young factory workers are able to put their earnings into savings accounts and women are better able to save money for important future expenses (“If I suddenly get sick, I can take out money from my bKash account for my treatment anytime.” —FII Bangladesh BRAC research) As financial services access continues to expand to the more than 50 million adults still without accounts, many more Bangladeshi will be able to save money securely, pay for medical expenses and plan for their futures.

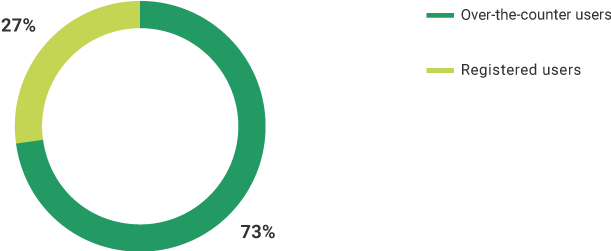

Despite Bangladesh leading the FII Asian countries in mobile money use, most mobile money transactions are conducted over-the-counter through unregistered accounts, preventing users from taking advantage of advanced features, such as electronic bill payments. In 2015, only one in 10 adults (9%) had a registered account. Beyond sending and receiving money, engaging adults in more advanced mobile money activities remains a challenge.

Financial Inclusion

Non-Bank Financial Institutions (NBFI)

Over-the-Counter Use

True or false

Gainfully employed adults are nine times more likely to be male than they are to be female.

True or false

Youth (ages 15-24) are more likely than above-poverty adults to be advanced phone users

Which demographic group is most likely to own a bank account and use it regularly (past 90 days)?

True or false

Bangladeshis are most likely to use non-bank financial institutions to access formal financial services

Financial inclusion is lowest among which demographic group?

True or false

The longer someone has used mobile money services, the more likely they are to be a non-registered (OTC) user of mobile money.