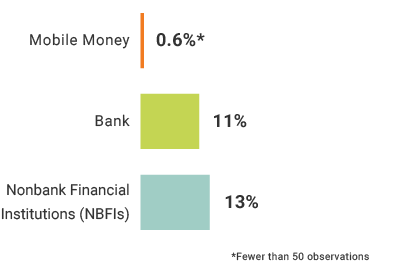

Since 2011, Myanmar, once considered one of the world’s most isolated economies, has undergone a dramatic democratic and economic transition propelled by the government’s adoption of new economic policies, health and education strategies, and prioritization of nutrition, rural development, and financial sector modernization. Amid this reform, the Government of Myanmar has increasingly been prioritizing financial sector reform to enable financial inclusion. In 2017, FII data revealed that less than one-fourth of adults (22%) in Myanmar were financially included, primarily via nonbank financial institutions (NBFIs) (13%) and banks (11%).

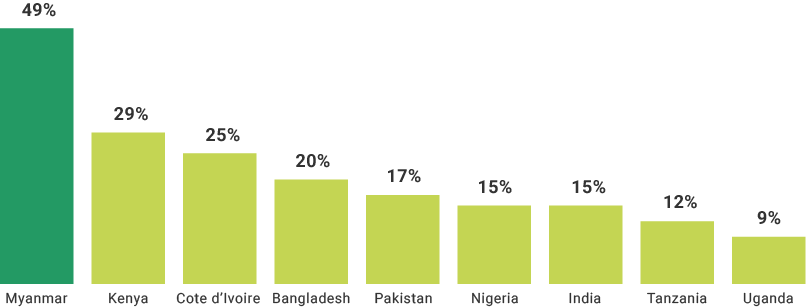

Less than 1% of the adult population held a mobile money account. Despite the newness of mobile money services in Myanmar, awareness of mobile money is high relative to other markets with similar levels of adoption. Three out of 10 adults (29%) in Myanmar were aware of mobile money services, which is significantly greater than it is in neighboring countries, such as India (18%), and other new markets for mobile money, such as Indonesia (15%, FII 2016). Relatively high levels of financial literacy (31%) and numeracy, combined with a high level of smartphone ownership (49%), are strong indicators of readiness to adopt DFS in the near future.

Financial Inclusion

Banks and NBFIs

Mobile Phones

True or false

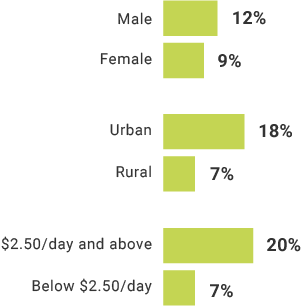

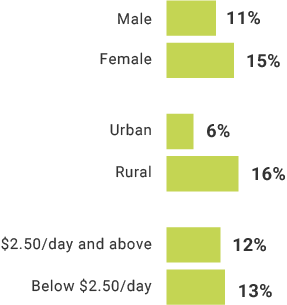

NBFI users in Myanmar are more likely male and urban adults, than female and rural demographic groups.

Which of the following demographic groups is lease likely to be financially included?

True or false

More men than women were financially included in Myanmar in 2017.

True or false

A significant proportion of Myanmar adults who used NBFIs were unregistered users or former users of these institutions.