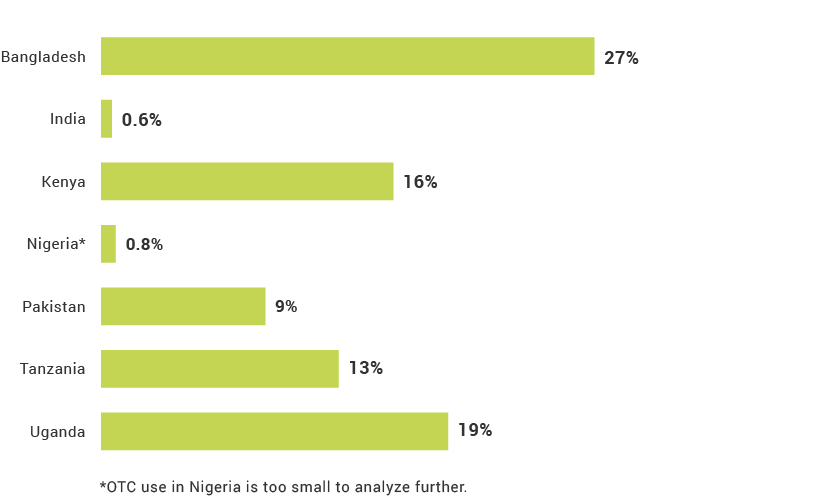

In many countries today, consumers first interact with digital financial services by reaching out to mobile money agents to help them send or receive money, without having to register for their own accounts. These over-the-counter (OTC) users are limited to transactions without registering with a formal financial service account. In Bangladesh, over a quarter (27%) of the population conduct transactions OTC; in Uganda, nearly one in five (19%) access mobile money via OTC methods.

OTC users have varied reasons for not registering with a mobile money account. Those who are less financially literate often depend on the help of an agent to make their transactions; the ability to use the account of a friend or relative hinders account registration, especially in Uganda. The lack of an identification card is another common reason among individuals across the FII countries, while others simply perceive a lack of need to have their own registered accounts.

Agent-assisted or OTC transactions are often consumers’ first—but not only—step toward financial inclusion. Agents play a critical role in explaining, instructing, and building a consumer’s comfort and skill level with a new financial activity. Technological advances and increased ease of digital payment use help consumers move from assisted transactions to independent transactions and eventually on to more advanced, active use of mobile money.

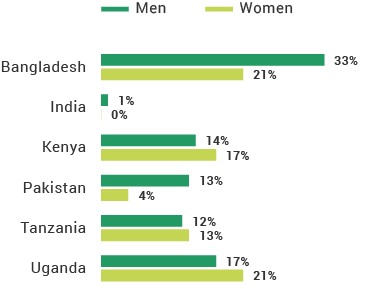

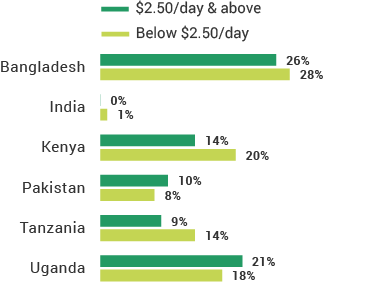

Over-the-Counter (OTC) Mobile Money Use

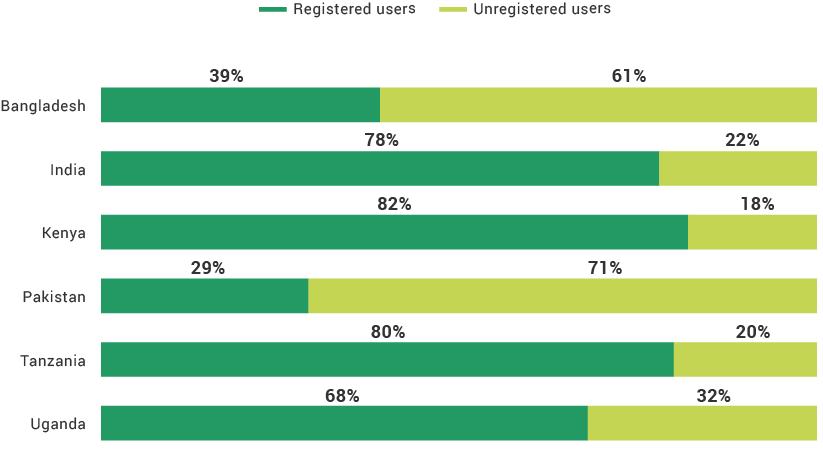

Percentage of Mobile Money Users Who Are Unregistered

True or false

In Bangladesh, registered mobile money users who have used at least one advanced function have increased by 5% from 2016 to 2017.

What is the top reason people in Bangladesh do not have registered mobile money accounts?

True or false

Mobile money services were first introduced in Kenya in 2007.