Access to financial services and financial education has helped youth (ages 15–24) in developing countries spend less time worrying about finances and more time in school concentrating on creating financial security for their future. People often do not consider youth, or a younger population, as needing access to financial services and tools. Youth are less likely to have stable sources of income than those over the age of 25 – making them more susceptible to major economic shocks such as family members’ deaths, medical emergencies, or loss of income sources. Access to financial services and improved financial education can help youth better prepare for their futures and avoid falling into poverty traps that have held back many in prior generations.

Youth Population

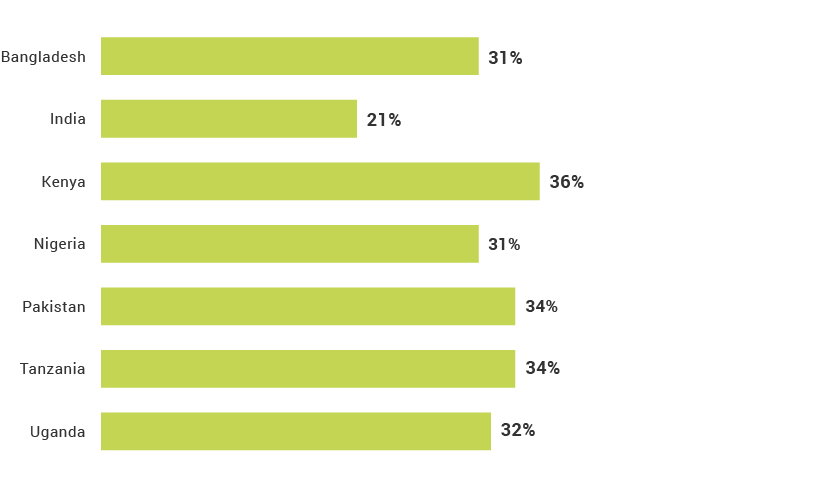

Financial Inclusion

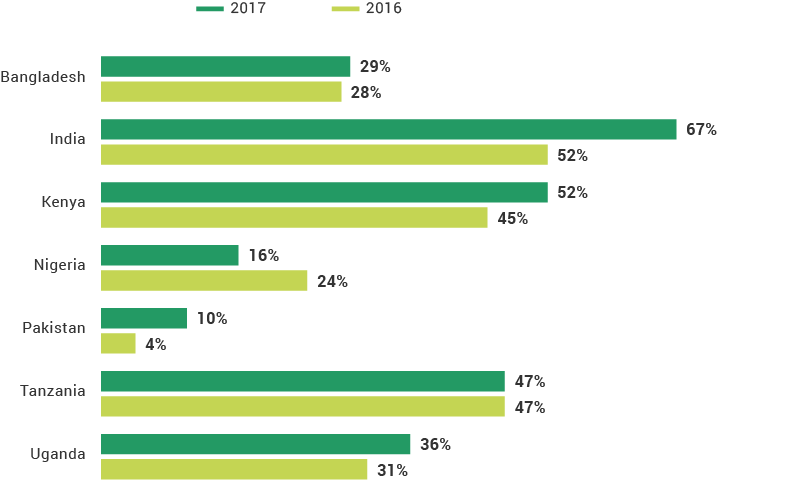

Saving

True or false

The primary reason youth in most countries give for not having a bank account is that they don’t need one.

Above 30% of youth are financially literated in all FII countries.

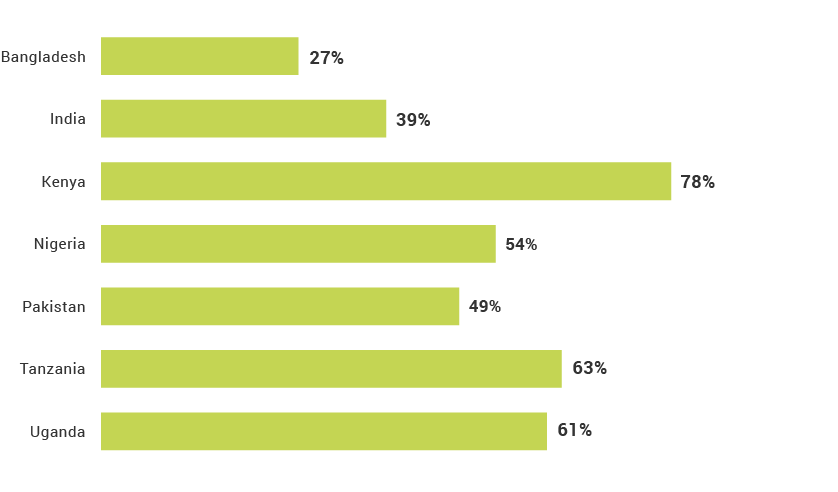

Which country has the highest percentage of youth who are financially included?

True or false

Youth are more likely to be literate, and have the ability to send/receive SMS than are those 25 years old and over

True or false

African youth are more likely to have borrowed money in the previous year than youth in other FII regions.

True or false

The primary reason that mobile-money-aware youth in Bangladesh and Pakistan report not using a mobile money account is that they don't need to use mobile money.