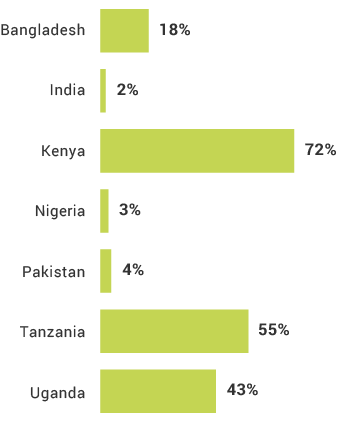

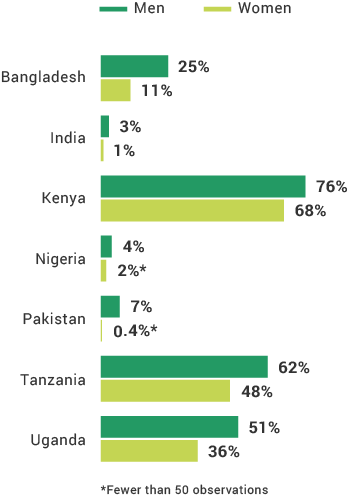

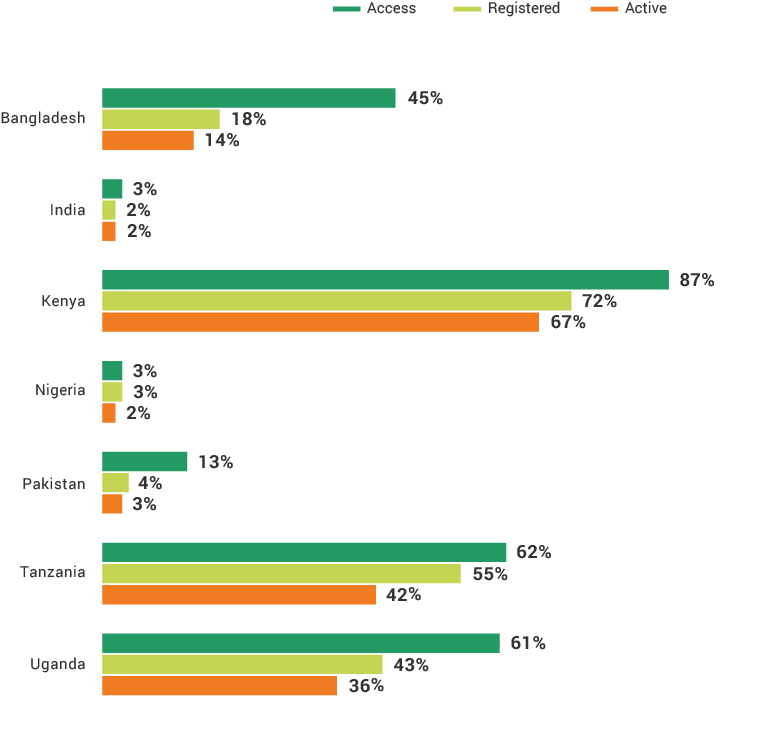

Consumers in the developing world are able to conduct financial transactions through their mobile phone providers, transforming their phones from communications tool to a financial access channel. From transferring money to paying for goods and services, the mobile phone functionality available today is transforming economies and empowering consumers. In Kenya, Tanzania, and Uganda, mobile money is the key driver of financial inclusion. Kenya remains the global leader in mobile money usage, with 72% registered mobile money account owners. With four key providers, Tanzania has the most competitive market, and Uganda boasts a high number (47%) of aware nonusers primed to open accounts. In Nigeria, India, Bangladesh, and Pakistan, banks and microfinance institutions drive financial inclusion.

Mobile Money Account Ownership

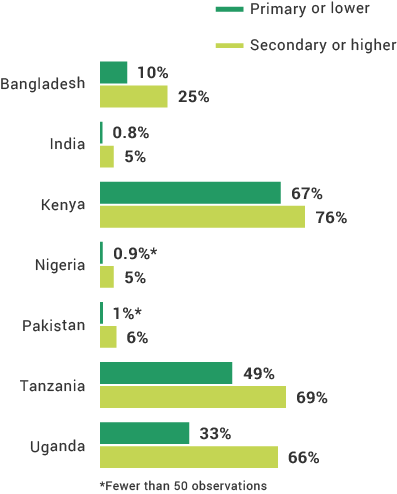

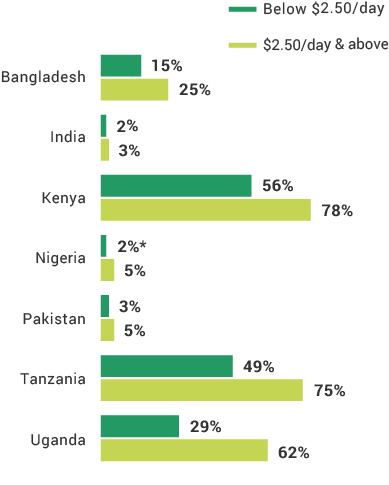

Mobile Money Accounts

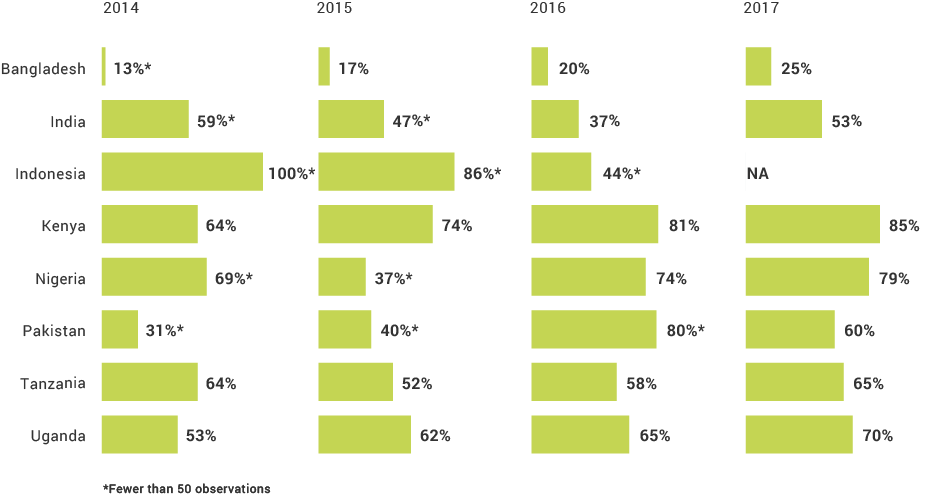

Advanced Use

In India, what percentage of rural adults have a mobile money account?

Which FII country has the highest percentage of adults with mobile money accounts?

What percentage of Bangladeshi youth have a mobile money account?

True or false

In 2017, India had the lowest percentage of mobile money account ownership among the FII countries.

True or false

Among the eight FII countries, Uganda has the largest gender gap in mobile account ownership.