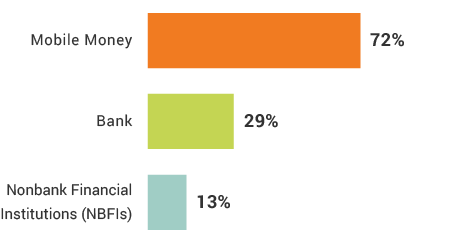

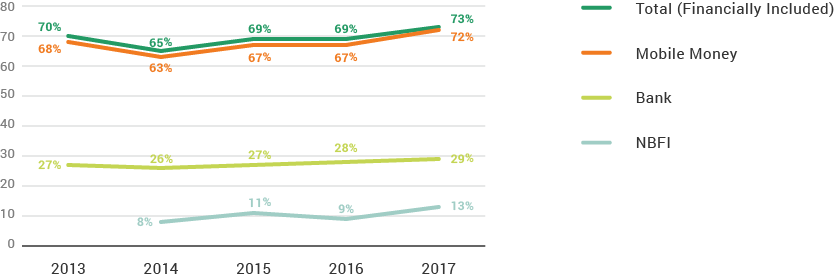

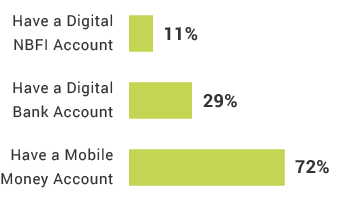

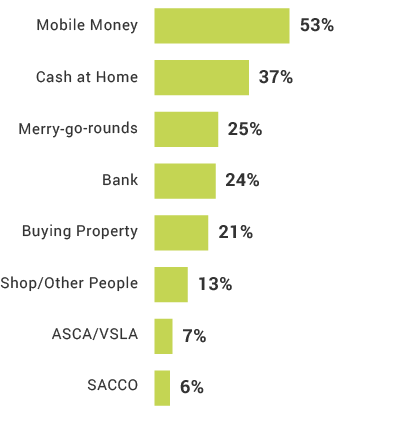

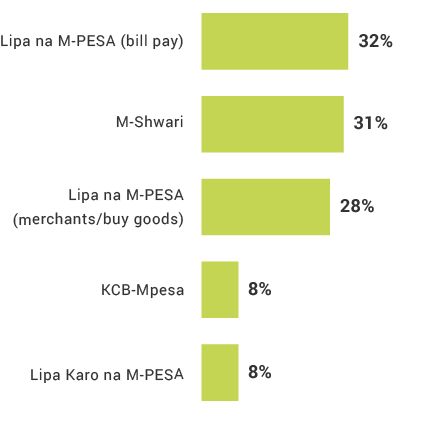

Kenya leads in developing mobile money payment systems and in widespread usage, despite battling extreme poverty. In 2017, more than seven in 10 adults were financially included (73%); and of these financial account holders, 98% held mobile money accounts. In 2017, the digital financial services (DFS) market in Kenya continued to develop beyond basic transfers as active mobile money users continued their rapid uptake of new and existing products and services for merchant and bill payments, government payments and transfers, and credit, savings, investment and insurance. The advanced user group, defined by their uptake of advanced services (beyond basic wallet & P2P), has grown by 16 percentage points since 2014, reaching 60 percent of adults in 2017.

In addition to mobile money, financial services are available through a diverse group of institutions, including banks, nonbank financial institutions and informal financial groups. Nearly two-thirds of the country is rural, and financial inclusion is helping improve Kenyans’ lives by enabling consumers to transfer money to relatives in small villages, pay school fees, buy health insurance or even light their homes using solar power.

Financial Inclusion

Mobile Money

Savings

Which demographic group is least likely to own a bank account?

True or false

Less than 50% of Kenyans are digitally included.

Which demographic group is most likely to own a mobile money account?

What percentage of adults borrowed money in 2017?

What percentage of adults were saving money in 2017?

True or false

More than 50% of Kenyan adults have insurance.