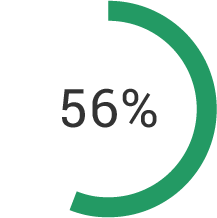

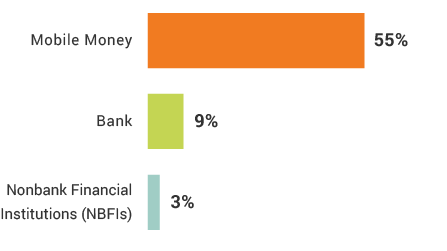

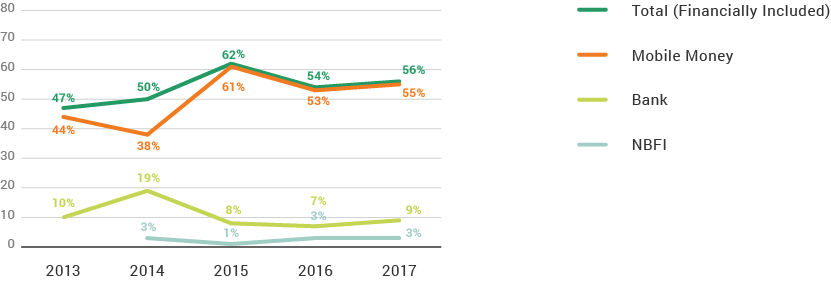

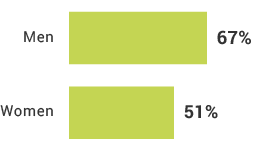

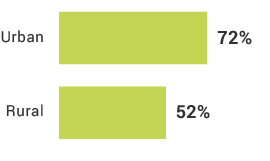

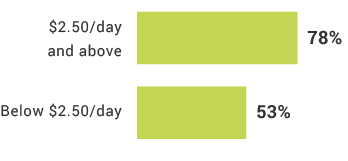

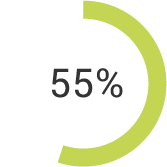

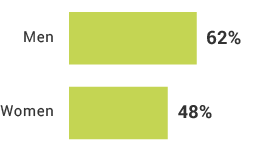

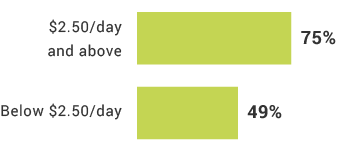

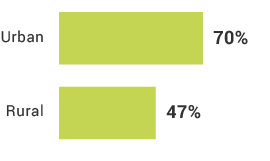

Today almost six in 10 adults (56%) in Tanzania are financially included, almost all through mobile money accounts (55%). Tanzania has a predominantly rural population, which makes access to financial services a challenge and digital solutions ideal. Sixty-six percent of the population resides in rural areas, and FII data shows that less than one-third (29%) of the rural population have active accounts (used in the last 90 days), whereas urbanites are twice as likely to have active accounts (61%). Approximately 77% of Tanzania’s adults live on less than $2.50 per day, with three-quarters of Tanzanians employed in the agriculture sector, according to World Bank data. In 2017, financial inclusion in Tanzania shows persistent gender, locality and income gaps; a smaller proportion of adults in the female, rural and below-poverty demographics are financially included compared to the male, urban and above-poverty groups. Making gains among these groups is key to improving Tanzanians’ financial lives.

Financial Inclusion

Mobile Phones

Mobile Money Use

True or false

Registration of mobile money increased between 2014 and 2017.

True or false

Financial inclusion in Tanzania is primarily through nonbank financial institutions (NBFIs).

Which demographic group was most likely to own a bank account in 2017?

True or false

Active mobile money use increased from 2014 to 2017.

What percentage of adults can borrow a mobile phone?

True or false

Mobile money usage is highest among men in Tanzania.