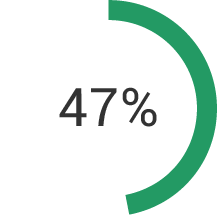

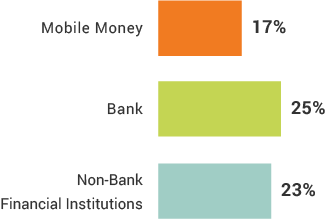

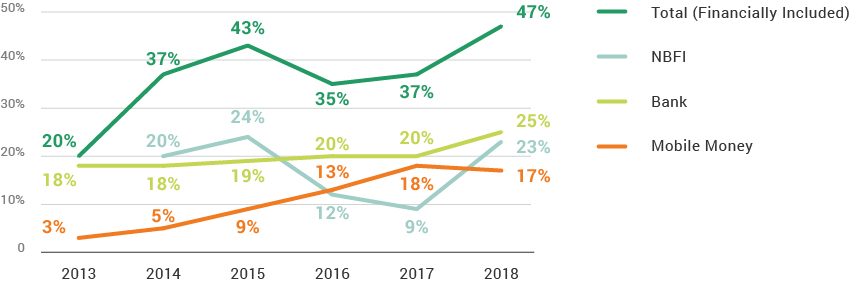

The Bangladesh government continues to make progress on its financial inclusion goals through the implementation of initiatives designed to reach the financially excluded, particularly the poor. Financially included adults made up 47% of the population in 2018, a 10 percentage-point increase from 2017. Banks drove this increase, partly due to the government’s push to expand agent-banking services in rural areas. This expansion has led to growth in the number of financially included individuals among the rural poor subpopulation. Registered bank users, among the rural poor, have increased by 7 percentage points since 2015 when agent banking was first introduced. Despite increases in registered bank account holders, there remains a 10 percentage-point gender gap in favor of men.

A key component of the government’s financial inclusion strategy is to promote a “Digital Bangladesh” that includes the uptake of mobile money and other digital payment platforms. In 2018, 35% percent of adults were digitally included via a mobile money, bank, or NBFI account with digital access compared with 28% in 2017. The number of registered mobile money users, however, remained the same from 2017 to 2018, at 17%. This was, in part, due to vigorously enforced know-your-customer rules.

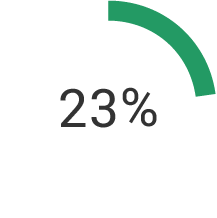

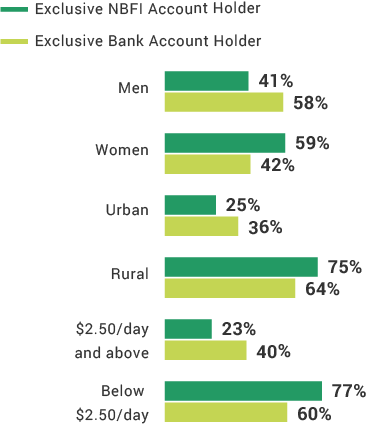

Nearly a quarter of adults (23%) were financially included through microfinance and other nonbank financial institutions (NBFIs) accounts. More people used NBFIs for savings and loans than any other type of formal financial institution. Registered account holders were more often women, rural and below-poverty groups in comparison to their demographic counterparts. Public and private entities continue to work with a variety of stakeholders to implement initiatives designed to reach more of the financially excluded − particularly the rural poor and women.

Financial Inclusion

Non-Bank Financial Institutions (NBFI)

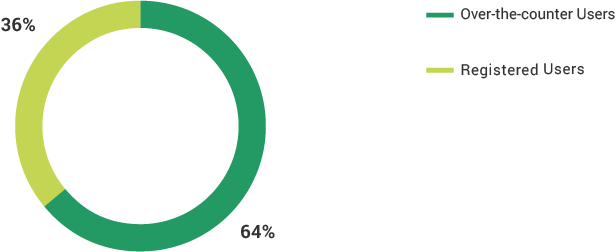

Over-the-Counter Use

Financial inclusion is lowest among which demographic group?

True or false

Financial inclusion in 2018 was driven by an increase in the number of adults who have registered bank accounts.

True or false

Fewer than 20% of adults have digital access to a registered financial account.

What percentages of females own their own phones?

True or false

Less than one-third of women (32%) accessed a digital payment or transfer vs. 56% of men.