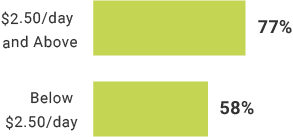

For more than two decades, access to banks and secure means of obtaining credit has enabled poor and female Indonesians to maintain small businesses and seek further education making them a part of Indonesia’s financially included population. As a result, they are in a better position to maintain their livelihoods without relying on financial help through unsavory means (such as loan sharks) to keep their businesses afloat. Indonesia has the highest per capital income among the seven other FII countries, according to The World Bank. It is ranked 100 globally, with Nigeria the next closest at 123, and is the most literate (83%) of all the FII countries. Six in 10 Indonesian adults (62%), however—more than 100 million people—remain in poverty, living on less than $2.50/day, which means Indonesians still need to be lifted out of poverty. Access to financial services is a tool that can make it a reality.

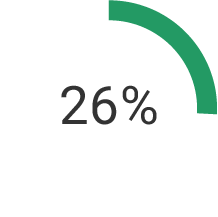

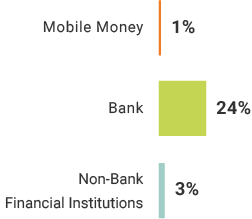

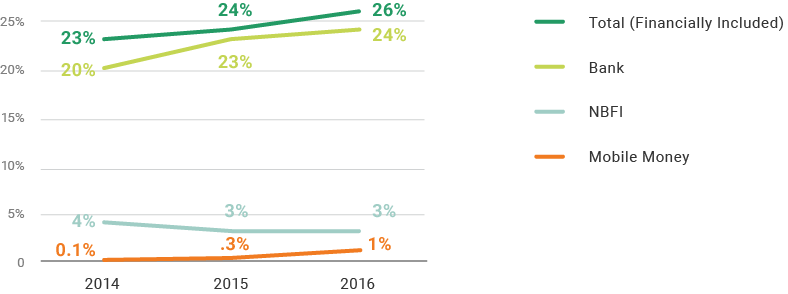

Financial Inclusion

Mobile Phone Ownership

Financial Behaviors

True or false

Gainfully employed Indonesians are most likely to be factory employees.

Which demographic group is least likely to own a bank account?

Awareness of mobile money did not increase between 2015 and 2016.

True or false

Digital financial inclusion decreases sharply as you move from those who live above the poverty line (more than $2.50/day) to those living in extreme poverty (less than $1.25/day).

Which demographic group is least likely to be active financial account users?

True or false

Banks are the most widely used form of financial services, formal or informal.