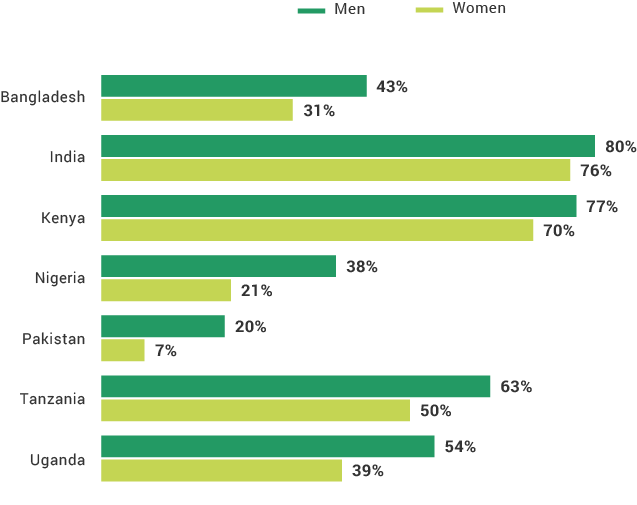

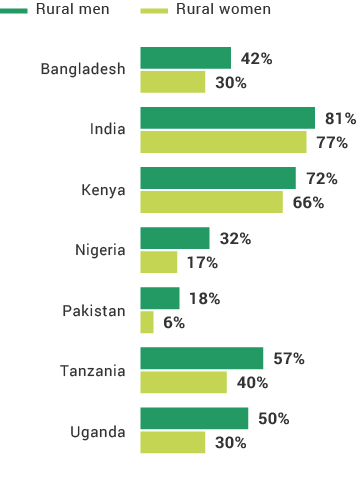

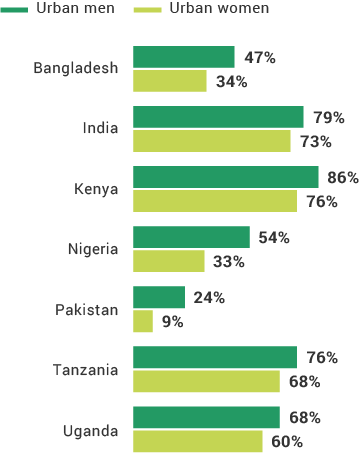

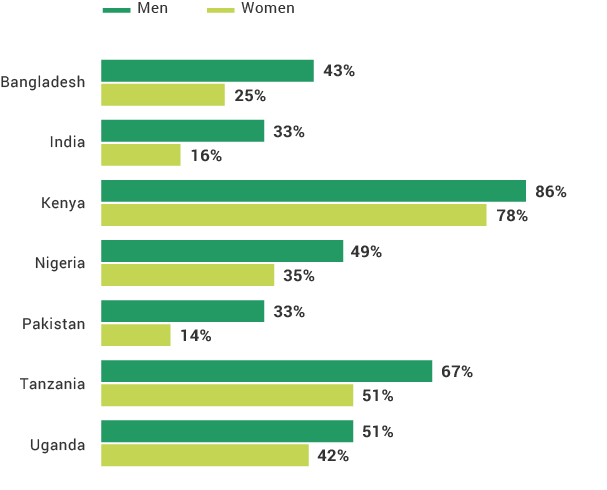

Government initiatives and technological advancements have helped to make large numbers of consumers financially included, but that number includes more men than women. Women lag behind men in use of financial tools and mechanisms across every measure, including mobile phone ownership, mobile money use, and bank account ownership. The disparity can be great—as it is in Pakistan, where a woman is 41 percentage points less likely than a man to own a phone —or relatively contained, such as in Kenya where there is an eight-point gender gap in mobile money usage. Opening the financial services world to women means greater independence and economic stability for them and their families. Closing the gender gap requires motivating women to adopt financial mechanisms at a rate more rapid compared to their male counterparts; otherwise, the gap will persist even if usage grows. FII’s annual surveys will continue to track and measure the trend in financial inclusion for women across FII countries.

Financial Inclusion and Gender

Use of Mobile Phones for Advanced Functions

Financial Literacy and Gender

True or false

India has a lower proportion of women in poverty than men in poverty.

In Kenya, what percentage of female mobile money account users have conducted an advanced function in the past year?

In India, what percentage of women are financially included?

The urban-rural gap in financial inclusion for women is highest in which African FII country?

True or false

Looking at the South Asian FII countries, Pakistan has a higher percentage of women with active digital stored-value accounts than Bangladesh or India.