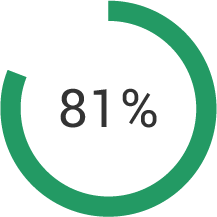

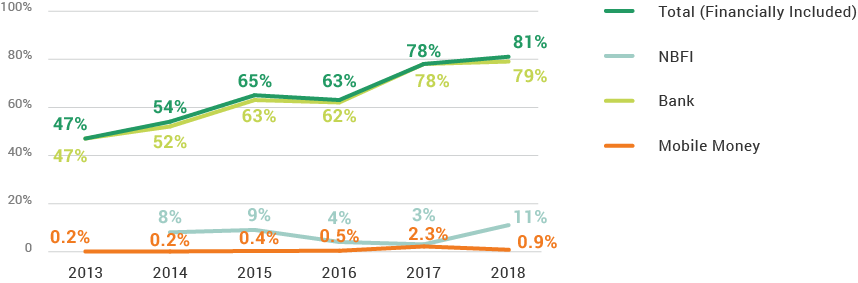

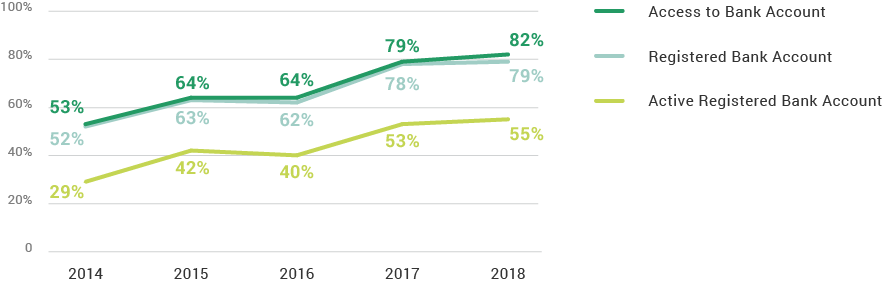

In August 2014, Prime Minister Narendra Modi announced the “Pradhan Mantri Jan-Dhan Yojana” (PMJDY) scheme to combat black money in the economy and provide 75 million unbanked Indians with zero-balance bank accounts— delivering access to a full range of financial services, including pension, credit and insurance. Between 2014 and 2018, the proportion of the financially included population grew from 54% to 81%.

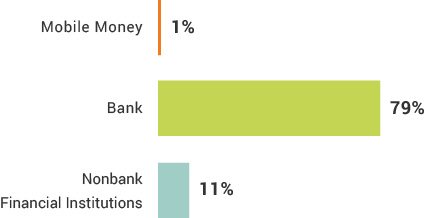

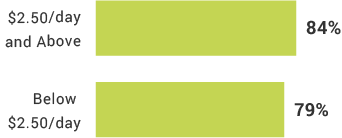

Bank accounts are the main driver of financial inclusion. Four in five (79%) adults in India had a registered bank account in 2018. In addition to PMJDY, the Indian government has enacted initiatives to expand quality and delivery of digital financial services (DFS) through Aadhaar biometric identification. Aadhaar cards are being linked with mobile phones, SIM cards and financial service accounts to improve delivery of government schemes and benefits. These initiatives have helped to grow the financial inclusion market in India and encourage previously underbanked populations such as women, rural and below poverty individuals to access formal financial institutions.

Financial Inclusion

Poverty

Banks

What is the most common type of insurance bought in India?

True or false

The main reason Indians do not register a bank account is lack of money to use the account.

What percentage of women in India own a mobile phone?

What percentage of the Indian population is numerate?

True or false

The largest gap in financial accounts being active or inactive is due to gender.