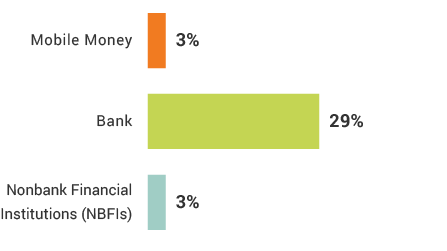

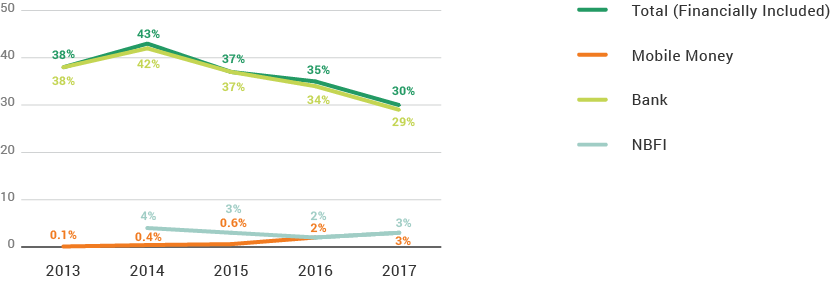

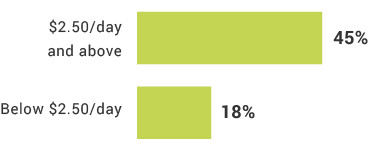

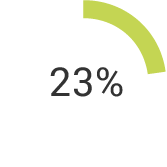

Nigeria’s financial inclusion landscape includes both great hope and great challenges. As Africa’s largest economy, Nigeria has the potential to drive consumers toward financial inclusion, yet internal strife and economic instability have made progress uncertain. Six in ten Nigerians (60%) live below the poverty line, with research showing that being poor, rural and less educated are all barriers to inclusion. Today, banking leads the way to financial inclusion, with nearly three in ten adults (29%) having bank accounts. Three in 100 adults (3%) have mobile money accounts and the same number (3%) have nonbank financial accounts. After committing to the Maya Declaration, the Nigerian government launched the National Financial Inclusion Strategy in 2012 to reduce the financially excluded to 20% by 2020. Although the goal is ambitious, the strategy reflects its long-term commitment to expanding financial services access and use to underserved populations.

Financial Inclusion

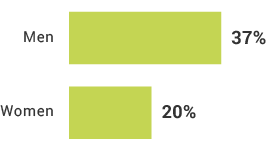

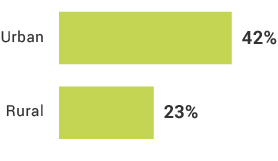

Registered Bank Accounts

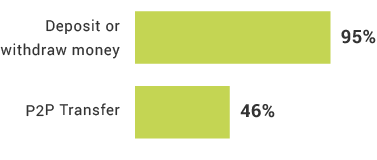

Active Bank Account Use

Which mobile money provider is the best known in Nigeria?

True or false

Adults living in rural areas are most likely to have their own bank account.

True or false

Financial inclusion in Nigeria is primarily through mobile money.

Nigeria has at least 10 mobile money providers.

Which demographic group is most likely to own a bank account?

True or false

Non-bank financial services are the second most widely used formal or informal financial services in Nigeria.