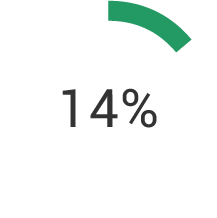

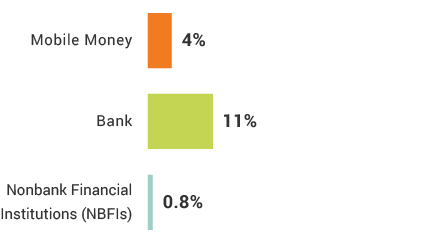

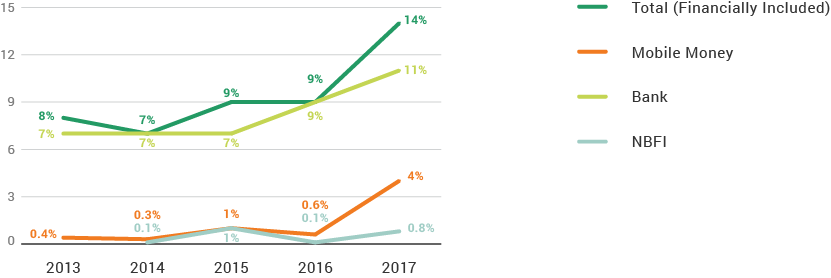

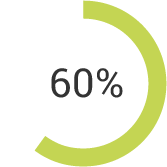

Pakistanis have intricate financial lives, mainly relying on unregulated, informal mechanisms to address their financial needs. Pakistan is one of the largest unbanked countries in the world, with only 14% of all adults being financially included. Although the nascent mobile money industry has enabled thousands of poor Pakistanis to remit cash and pay bills with ease, banks still lead the way in account registration. Between 2013 and 2017, bank account holders grew by 4 percentage points. Today, almost eight in 10 Pakistanis (76%) are aware of a mobile money provider; mobile money users remain largely OTC users, who grew by 4 percentage points between 2016 and 2017 while only four percent have registered accounts. Turning awareness to use will position the country to make leaps in financial inclusion.

Financial Inclusion

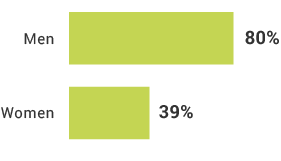

Mobile Phone Ownership

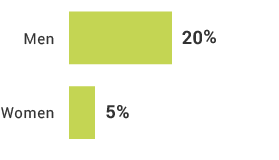

Mobile Money Use

True or false

Gainfully employed Pakistanis are most likely to be shop or business owners.

Which demographic group is most likely to be financially included?

More mobile money users are using the services for advanced functions than in previous year.

True or false

Most mobile money users in Pakistan are registered account holders.

True or false

Less than one in 10 Pakistanis are financially included.