New FII data reveals strong growth in users of mobile money for advanced activities such as bill pay, savings, investment, and insurance

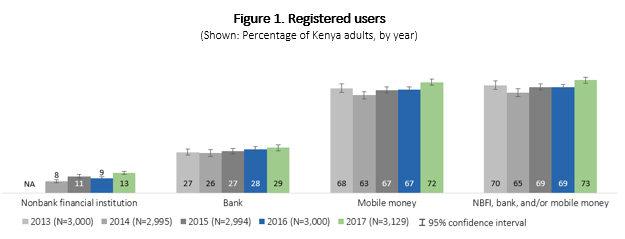

In Kenya, financial inclusion increased from 69% of the adult population in 2016, to 73% in 2017. Mobile money is the driving force behind the country’s high levels of financial inclusion; 98% of included adults had a mobile money account. Further, 9% of adults progressed on the customer journey to join the advanced user group, mainly by using mobile money to save, borrow, pay bills, and/or pay for goods and services.

Kenya is marked by extensive access to financial points of services (POS), particularly mobile money agents. In 2017, 89% of adults knew of a POS within 5 km of their home, and 78% knew of one within 1 km. Accessibility and ease of use were the top reasons reported for using mobile money over alternatives.

Growth in advanced users is fueled by the adoption of mobile money for activities that go beyond basic transfers and buying mobile phone airtime. A growing ecosystem of specialized products and services is meeting demand from advanced users.

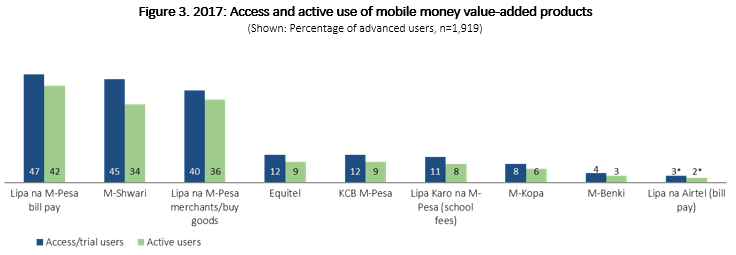

In 2017, six in 10 adults were advanced active registered users of financial services, up from 44% in 2014 (Figure 2). Parallel to the steep increase in advanced users, the market for advanced services continues to develop with the launch of new products such as Pesalink, M-Pesa 1 Tap and M-Fanisi that cater to the needs of a greater range of users. Products are also being modified and rebranded. For instance, Orange Money was rebranded as T-Kash and, more importantly, the service simplifies the process of withdrawing cash from an agent or ATM as well as paying for goods and services.

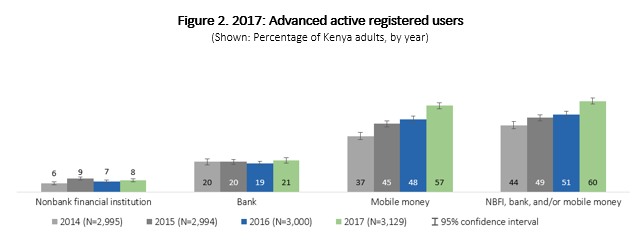

Mobile money value-added products boast strong customer engagement and retention. Value-added products like M-Shwari saving and credit, make mobile money a gateway to services from other providers, such as banks and payment aggregators linked to the individual mobile money account on the backend. These products show strong customer retention among the advanced user group (Figure 3); most of those who had ever used the products were active users at the time of the survey (used the service within 90 days prior to the survey). Lipa na M-Pesa (a mobile-based payment system) has been widely adopted as a means of paying bills and buying goods, and, in 2017, was the most used value-added product. M-Shwari (a mobile wallet used both for saving and borrowing), was the second most commonly used product among advanced users. Evidently, DFS is slowly but surely replacing cash as a preferred mode for advanced activities.

Even as financial inclusion continues to soar and engagement with DFS deepens, there is a need to address barriers such as the gender gap in financial inclusion (7% more men than women) and financial literacy, at only 28% of adults. The FII team will continue to track how these challenges evolve; it will be particularly important to monitor how Kenya ensures that more adults progress to the advanced user stages of the customer (deeper and more widespread use of DFS).

Can you derive any recommendations for accelerating advanced use of financial accounts from InterMedia’s Data Fiinder? We’d love to hear from you.

For more information regarding the FII team’s research in Kenya, read the 2017 Kenya Annual Report, or contact Beatrice Cheronoh, Research Manager, Financial Inclusion Insights. If you are interested in seeing additional information about the factors that affect financial inclusion in Kenya, we encourage you to visit the Data Fiinder at finclusion.org.

Financial Inclusion Insights is an ongoing research program funded by the Bill & Melinda Gates Foundation and designed to build meaningful knowledge about how the financial landscape is changing across eight countries in Africa and Asia (Bangladesh, India, Indonesia, Kenya, Nigeria, Pakistan, Tanzania and Uganda).